Rational View on China Meltblown Fabric Market

By Scott Chin • 06/3 @ 7:20 • Rational View on China Meltblown Fabric Market已关闭评论

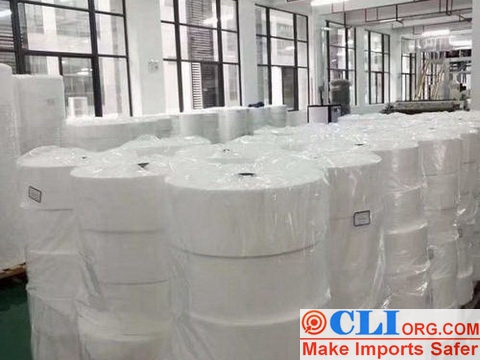

If the global COVID-19 epidemic is not effectively contained in the short term, the demand for China meltblown fabric market will remain high in the first half of 2020 and will even continue to rise. Meltblown cloth has the characteristics of fine fibers, large specific surface area, small porosity and large porosity. It can be used as materials for sound absorption, heat preservation, filtration, oil absorption, cleaning, etc. It is widely used in medical and health, industry, household life, military, aviation and other fields. The outbreak of the COVID-19 epidemic has brought about a surge in the demand for masks, which has led to a surge in the demand for meltblown fabrics in China. The development of China meltblown fabric market has become a topic of concern in the industry.

Enterprises Convert Production, Expand Capacity or new Meltblown Cloth Projects

In 2019, China will have 61 continuous melt-blown nonwoven production plants with 137 production lines, with a production capacity of 83,000 tons/year, with an actual output of 57,000 tons/year, accounting for only about 1% of China’s total nonwoven production.

On the whole, China meltblown fabric market has a pattern of private enterprises, joint ventures, state-owned capital holdings, foreign investment and other enterprises competing in the same competition. On the basis of introducing and absorbing foreign technologies, Chinese enterprises have developed rapidly in recent years. but compared with multinational enterprises such as the United States and Japan, meltblown fabric manufacturer in China is characterized by backward technology, low efficiency of equipment, small production scale and scattered production capacity. Its business mainly focuses on better application of meltblown cloth to downstream products. It does not have the production capacity of upstream raw materials, has no enterprise to develop the whole industrial chain, and has weak overall competitiveness. However, multinational enterprises are mostly from the chemical industry. Their business and technology are often focused on the technological innovation and industrial mass production of meltblown cloth substrates, and extend to the downstream consumer end. The development mode of the entire industrial chain in the upper, middle and lower reaches has obvious characteristics.

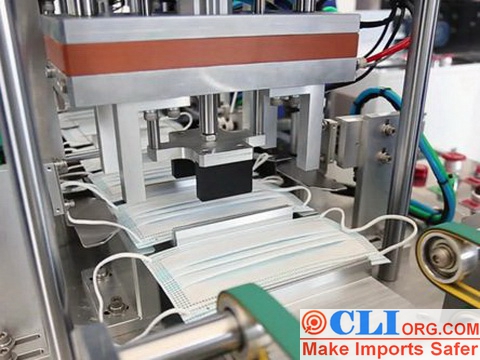

The outbreak of the COVID-19 epidemic has caused the demand for medical protective materials to soar such as masks . At that time, the demand for meltblown cloth, an important raw material for mask production, surged, and the demand was in short supply. Some enterprises have changed production, expanded capacity or built new meltblown cloth projects. Sinopec has invested about 200 million yuan to build 10 meltblown cloth production lines in Beijing Yanshan Petrochemical Company and Jiangsu Yizheng Chemical Fiber Company. The designed production capacity of Yanshan petrochemical production line is 14,400 tons/year, including 2 meltblown cloth production lines and 3 spunbond cloth production lines, which can produce 4 tons of N95 mask meltblown cloth or 6 tons of medical planar mask meltblown cloth and 42 tons of spunbond cloth every day. The project has produced qualified products on March 6. Sinopec is speeding up the preparation of another 8 meltblown cloth production lines in Yizheng, Jiangsu, with a total production capacity of 4000 tons/year, which was completed and put into operation in May. The construction of PetroChina’s four meltblown cloth production lines has also been fully carried out in Liaoyang Petrochemical and Lanzhou Petrochemical respectively, and has been completed in May with an annual output of 2200 tons.

However, on the one hand, because of the high technical content in the melt-blown cloth production process, the production line investment cost is relatively high, and China can provide complete sets of meltblown fabric production machine, there are not many manufacturers of the key components, and the delivery cycle and assembly time of imported equipment are relatively long, which limits the rapid growth of meltblown cloth production capacity in the short term. On the other hand, as some enterprises are worried about the real introduction of meltblown cloth production lines, the peak demand brought by the epidemic has passed, thus hindering many investors from entering this field. Based on the above factors, it is estimated that the production capacity of meltblown cloth will increase by about 15,000 tons in 2020 (including the 6 additional production lines planned by Sinopec), and the production capacity is expected to reach about 100,000 tons.

At present, the market demand is still facing a big gap

Under normal circumstances, the demand for China meltblown fabric market is not large and the market is in a tepid state. The demand in 2019 will be about 67,000 tons/year. Among them, masks account for about 25% of the consumption of meltblown cloth.

The new crown pneumonia epidemic since the beginning of the year has caused a sharp increase in the demand for medical and health supplies such as masks and protective clothing. Although the daily output of masks currently exceeds 100 million and another 100 million masks are imported per day, the market demand is still facing a large gap. As enterprises resume work and production and students resume their studies, the demand for masks will also rise rapidly. At present, the number of employed people in China is about 770 million, of which 9.5 million are medical personnel. The total number of primary and secondary school students is about 250 million. The following three scenarios are used to reasonably calculate the demand for meltblown cloth.

(1) only return to work, return to work rate of 50%.

There are 380 million medical face masks, 4.75 million N95 face masks, 300,000 N95 face masks or 1 million medical face masks can be produced by 1 ton of melt-blown non-woven fabrics (calculated based on the following scenarios), 396 tons/day (145,000 tons/year) of melt-blown non-woven fabrics are required, an increase of nearly 1.2 times compared with the normal situation. Assuming that the existing 83,000 tons/year (227 tons/day) meltblown non-woven fabric production capacity is all started for mask production, there is still a gap of 169 tons/day (62,000 tons/year).

(2) only return to work, return to work rate of 100%.

There are 760 million medical face masks, 10 million N95 masks and 792 tons of meltblown nonwoven fabric per day (290,000 tons per year), an increase of 3.3 times compared with the normal situation. Assuming that the existing 83,000 tons/year (227 tons/day) meltblown non-woven fabric production capacity is all started for mask production, there is still a gap of 567 tons/day (207,000 tons/year).

(3) The return to work rate and return to school rate are both 100%.

1.01 billion medical face masks and 10.0 billion N95 face masks are required daily, while 1,042 tons/day (380,000 tons/year) of meltblown nonwoven fabric are required, an increase of 4.7 times compared with the normal situation. Assuming that the existing 83,000 tons/year (227 tons/day) meltblown non-woven fabric production capacity is all started for mask production, there is still a gap of 814 tons/day (297,000 tons/year).

At present, although China’s epidemic situation is effectively controlled, overseas epidemic situation has spread. If it cannot be effectively contained in the short term, the market demand for meltblown fabrics will remain high in the first half of 2020, and will continue to rise. However, with effective control of the epidemic, it is expected that the future demand for meltblown cloth will gradually return to rationality. But overall, with the expansion of new technologies, new equipment and new application fields in the industry, the demand for meltblown fabrics in China will maintain a steady growth trend in the next few years.

Market Demand of Meltblown Cloth Will be Rationality

To sum up, under normal circumstances, China meltblown fabric market is relatively small, mainly concentrated in high-end products. Under special circumstances such as epidemic situation, the supply gap of meltblown cloth is between 60,000 and 300,000 tons/year. It is expected that with the effective control of the epidemic situation in the future, the demand for meltblown cloth will gradually return to rationality, and the overall strength of the industry will also be significantly improved. The central enterprises such as Sinopec and PetroChina will form a full industrial chain development model of polypropylene fiber material-meltblown material-meltblown cloth in the upper, middle and lower reaches. Refinement of technology, functionalization of products, integration of structures, substitution of applications and differentiation of meltblown cloth market will become the future development direction.

As far as process technology is concerned, meltblown technology involves multidisciplinary cross-disciplines, such as textile, fiber, papermaking, film, composite and other technologies. In the future, the direction of technology research and development is as follows: on the one hand, focus on the research and development of new meltblown technology and the upgrading of existing technologies to realize the integration and development of technologies in the above fields; On the other hand, we will intensify research and development of new raw materials, improvement of raw materials and optimization of formula.

In terms of new product development, in view of the deep subdivision of the downstream products of meltblown cloth, one is to adhere to the product differentiation route, especially in the fields of masks, thermal insulation wadding and oil absorption materials, which are widely used in the tradition. The second is to adhere to the functional line of products and give full play to the characteristics of meltblown cloth in antibacterial, breathable, flame retardant and high temperature resistance. The third is to adhere to the environmental protection route of products. On the one hand, it is to improve the environmental protection of meltblown raw materials, such as the oneness, recyclability and degradability of raw materials. On the other hand, the unit gram weight is reduced while the same performance is achieved.

In terms of downstream user expansion, on the one hand, it is to expand new fields, broaden the melt-blown cloth market, give priority to with the uniqueness and high functionality of products, realize the application of new fields and occupy the market; On the other hand, the main focus is on alternative fields, with low cost and substitutability as the main focus, so as to meet the performance of products in alternative fields while reducing the production cost of downstream users, such as sound-absorbing materials applied to highway tunnel construction, water-permeable materials used for soilless cultivation of flowers, antiskid and breathable shoe-making materials and automobile interior materials, etc.

This article is an original article for CLI Inspection, who is committed to providing high-quality product inspection technology and know-how sharing for global importers and retailers to make imports safer.

All rights reserved. The contents of this website provided by CLI Inspection may not be reproduced or used without express permission.

For reprint, please contact with CLI Inspection, thank you.

Scott Chin

Senior professionals in the field of quality inspection are committed to finding and sharing valuable experiences.

SEARCH

Email Subscribers

Recent Posts

- register-081823 08/18 @ 8:03

- A Few Tricks to Teach You How to Easily Buy Luggage Case Bags With High Cost Performance ? 04/20 @ 8:47

- You Can’t Imagine That A Big Brand Like KAPPA Will Find Serious Batch Problems During Inspection! 04/13 @ 9:08

- Folding Table: Technological Comparison Between Two Factories 04/6 @ 8:45

- Are You Still Worried About Clothes Damaged by Hangers? 03/29 @ 8:26

Recent Comments

Monthly Files

Catalogue

Tags

BLOG

- register-081823 08/18 @ 8:03

- A Few Tricks to Teach You How to Easily Buy Luggage Case Bags With High Cost Performance ? 04/20 @ 8:47

- You Can’t Imagine That A Big Brand Like KAPPA Will Find Serious Batch Problems During Inspection! 04/13 @ 9:08

- Folding Table: Technological Comparison Between Two Factories 04/6 @ 8:45